Bonds vs Stocks Overview, Characteristics, Example

An advanced trading strategy for cross-market assets is pairs trading, where you can open one long position and one short. However, there must be a positive correlation at the time of settling the contract for the strategy to work. The aim of pairs trading is to hedge risks in your trading portfolio by balancing positions that act as a hedge against each other.

- If you’re looking for the chance to earn a higher return, you’ll probably want to consider investing in stocks.

- Another option is to buy stocks and bonds through a mutual fund or an exchange-traded fund (ETF).

- By buying a bond, credit, or debt security, you are lending money for a set period and charging interest—the same way a bank does to its debtors.

- For example, if you buy a bond with a 2% yield, it could become more valuable if interest rates drop, because newly issued bonds would have a lower yield than yours.

- Stocks and bonds are two different classes of investments, and they have certain features that work for or against you in different ways.

Our estimates are based on past market performance, and past performance is not a guarantee of future performance. In India, central government, state government, local self-government, public sector establishments and private sector companies have the right to issue bonds. Bonds of the central government are known as Treasury bonds, which has a lock-in period of 20 years on which half yearly interest is paid.

If you start investing when you’re young, you can put a larger percentage of your portfolio in stocks because of the long-term reward, which will mitigate the risk of stock volatility. As you get closer to retirement, you’ll want to gradually shift toward more bonds to offset the growing short-term risk. Stocks fall under two main categories, common stock and preferred stock, and preferred stock is further divided into non-participating and participating stock.

But there are some things investors can do to try to manage the risk. Like the name suggests, common stock is the type of stock that people buy most often. And it might be what first comes to mind when you think about stocks. Try to keep them in mind when choosing which investments to make. Each bond has a certain par value (say, $1,000) and pays a coupon to investors. For instance, a $1,000 bond with a 4% coupon would pay $20 to the investor twice per year ($40 annually) until it matures.

Yet, the high yield of preferred stocks is positive, and in today’s low-interest-rate environment, they can add value to a portfolio. Adequate research needs to be done about the financial position of the company, however, or investors may suffer losses. Companies selected for inclusion in the portfolio may not exhibit positive or favorable ESG characteristics at all times and may shift into and out of favor depending on market and economic conditions. Environmental criteria considers how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates.

Avoid Self-Inflicted Losses in a Down Market

But as you move closer to that goal, such as retirement, paying for a child’s education, etc., you should move more of your assets into bonds. The idea is to maximize the wealth-building power of stocks over the long term while using bonds to protect that wealth. Importantly, funds are a way for investors to instantly diversify their portfolio by spreading their risk among many different companies, says Lee.

Conversely, when the economy is growing, and unemployment is low, investors are more confident. They are a form of debt and appear as liabilities in the organization’s balance sheet. While stocks are usually offered only in for-profit corporations, any organization can issue bonds.

- Shareholders receive any money that is left over from debt repayment, which may not be any at all.

- This is considered a high-risk investment given the speculative and volatile nature.

- In a new issue, millions of dollars of bonds are commonly available.

- Far fewer people own bonds, a type of fixed-income investment that represents your share in a loan made to a company, government or other entity.

- That capital appreciation is one of the main reasons stocks help investors build wealth.

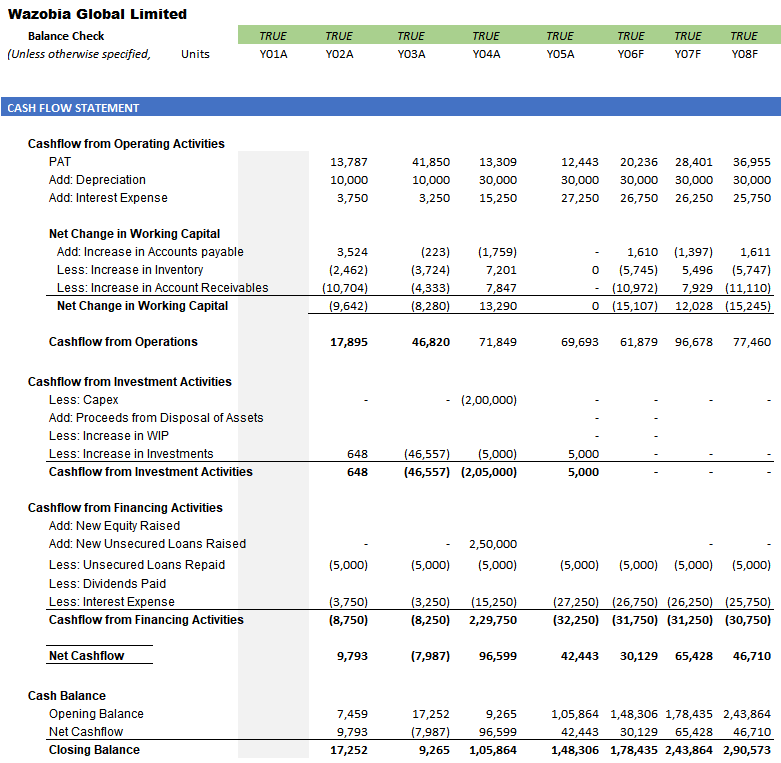

The table below includes various asset classes such as cash, fixed income, equity, and real estate. The global bond market is larger than the global stock market. But despite the prevalence of bonds, investors tend to know much less about them relative to equities. You can buy bonds outright or purchase part of a basket of bonds using an ETF or mutual fund.

In return, they promise to pay back the initial amount that they borrowed, in addition to interest. Interest represents the compensation rate that the investor, who is the lender in this situation, requires. Both types of investments have a deep history within the capital markets. To understand which investments are more suitable for the individual investor, one must understand what the securities are, the return that they provide, and the risk that they carry.

Selling a Business? Brokers Share Tips on How to Maximize the Sale Price

Many investors are unable to tolerate the volatility and end up buying or selling at the wrong times. But those who buy and hold stocks for many decades usually end up making money. Between issuance and maturity, the bondholder receives regular interest payments.

Comparing stocks and bonds

While stocks are ownership in a company, bonds are a loan to a company or government. Because they are a loan, with a set interest payment, a maturity date, and a face value that the borrower will repay, they tend to be far less volatile than stocks. That’s not to say they’re risk-free; if the borrower has financial trouble what is a trader and is at risk of defaulting on their debt, bonds can lose value. But even in a worst-case scenario of bankruptcy liquidation, bond holders are ahead of other debtors and shareholders to get repaid. The bond market does not have a centralized location to trade, meaning bonds mainly sell over the counter (OTC).

What Are the Differences Between Stocks and Bonds?

Early Payday depends on the timing of the submission of the payment file from the payer and fraud prevention restrictions. Funds are generally available on the day the payment file is received, up to 2 days earlier than Cci indicator the scheduled payment date. The number of securities that first started trading on the New York Stock Exchange on May 17, 1792—the first day of trading. Residents, Charles Schwab Hong Kong clients, Charles Schwab U.K.

Companies in the financial and utilities sectors mostly issue preferred stocks. Whatever your own long-term financial goals, you need a well-diversified portfolio to help you achieve them. And that smart diversification is likely to include a fitting combo of both stocks and bonds.

AccountingTools

Whether you should own more stocks or bonds in your portfolio depends largely on the timing and cost of your financial goals and how comfortable you are with risking your money. When you own a stock, you’re buying a piece of equity ownership in the company. Stocks have greater growth potential but also more volatility, which can hurt an investor’s Complete Beaxy Review financial goals and erode returns. Bonds are more stable investments that can provide income but have much less upside. Dividend stocks are often issued by large, stable companies that regularly generate high profits. Instead of investing these profits in growth, they often distribute them among shareholders — this distribution is a dividend.

Preferred Stocks vs. Bonds: An Overview

These all-in-one funds are a mixture of stock funds and bond funds that move along a glide path to become more conservative the closer you get to your goal date, says Lee. That usually means increasing bondholdings and decreasing stockholdings. Target-date funds aren’t for everybody, but they can be an easy solution for someone with specific retirement and college planning needs and little interest in devising their own investment strategy.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Stocks offer ownership of a Business and a share of any cash distributions (‘Dividends‘). Bonds offer the ability to participate in Lending to a Business but no ownership.

Rather, you receive regular Interest Payments and repayment of the Bond principal at the end of the Bond’s life. As part of the process, the Company typically raises new shares (usually to fund growth), which lowers the ownership of (‘Dilutes‘) existing shareholders. This not only caps the investor’s upside potential but also poses the problem of reinvestment risk. But the “right mix” really depends upon each individual investor’s risk tolerance, timeline, and strategy.